Unlocking Peace of Mind: Safeguarding Your California Real Estate Assets with a Trust and Estate Plan

Real estate isn't just about transactions; it's a cornerstone of your legacy. As a homeowner in California, understanding the significance of protecting your assets through a Trust and Estate Plan is paramount. Beyond the emotional investment, there are practical and financial considerations that make this a crucial step.

**1. Avoiding Probate Costs: Probate court proceedings can be time-consuming and costly. California, in particular, is known for having a complex and often lengthy probate process. By establishing a Trust, you sidestep the need

for your assets to go through probate, saving your loved ones both time and money. Probate costs in California are based on the gross value of the estate, and these expenses can quickly add up. A Trust allows for a smoother transition, bypassing probate fees and potential legal battles.

**2. Tax Benefits: California has specific tax laws that impact real estate. Through strategic estate planning, you can minimize the tax burden on your assets. A well-structured Trust provides opportunities for tax savings, ensuring that your beneficiaries receive the maximum value without unnecessary deductions. This foresight can significantly impact the financial well-being of your heirs.

**3. Control and Privacy: A Trust allows you to maintain control over the distribution of your assets. Unlike the public nature of probate proceedings, Trust administration is private. This means your affairs remain confidential, protecting your family from unnecessary scrutiny during an already challenging time.

**4. Streamlined Succession Planning: California's real estate market can be dynamic, and having a Trust in place streamlines the process of transferring your assets to your heirs. Whether you're passing on a family home or investment properties, a Trust ensures a seamless transition, reducing the likelihood of disputes among beneficiaries.

**5. Flexibility in Decision-Making: Life is unpredictable, and your financial situation may change. A Trust allows for flexibility in decision-making. You can amend or revoke your Trust during your lifetime, adapting it to your evolving needs. This adaptability is a valuable feature, especially in a state with ever-evolving laws and regulations.

**6. Professional Guidance: Navigating the intricacies of California's legal landscape requires expertise. Consulting with a licensed Trust Attorney ensures that your Trust is tailored to your specific needs and complies with state laws. While there may be initial costs associated with creating a Trust, the long-term benefits far outweigh these expenses.

In conclusion, protecting your real estate assets in California goes hand-in-hand with establishing a Trust and Estate Plan. Beyond the financial advantages, this proactive step grants you control, privacy, and peace of mind. Consider it an investment in your family's future, safeguarding your legacy for generations to come. Don't let uncertainty dictate the fate of your assets – take charge with a comprehensive Trust and Estate Plan today.

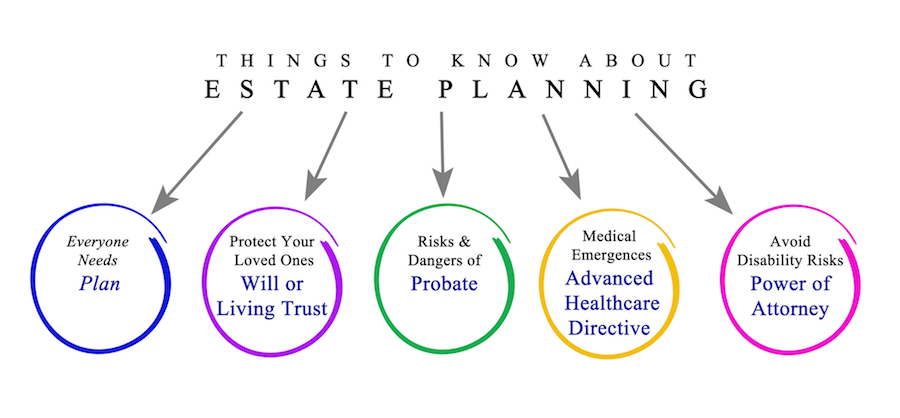

Understanding the components of an Estate Plan and Living Trust and how they help you and your family members is a crucial part of avoiding costly, stressful scenarios down the line when you own real estate. We aren't Trust or Tax attorneys here at Nest Socal, but we have seen the direct impact on clients and their families when an untimely or even expected death due to illness occurs without a Trust in place. That is why we are so passionate about educating our clients regarding the importance of putting a plan in place before it is needed.

To find out how Nest Socal Group at Y Realty is directly contributing and committed to helping 50 families establish their Trust and Estate Plan in 2024, watch the video here on our YouTube Channel, call us at 714-514-5643, or email us at infonestsocal@gmail.com. Need a Trust or Estate Planning Attorney Referral? We have vetted, trusted professionals to refer that we've had great experiences with personally and professionally!

Categories

Recent Posts