The Value of Your Realtor and NAR Settlement Implications

There is a LOT of talk in the news this week, about Realtors and commissions, and a sad but ever familiar undercurrent echoes in the messaging being reported by News and Media outlets….basically accusing Brokers and Realtors of rigging the system and making too much money. The National Association of Realtors (NAR) lawsuit settlement announcement that was talked about in the news this week has been a topic of conversation among the Realtor community for many months, ever since the first-class action lawsuits were filed against several large brokerages like Re/Max, Redfin etc. That first class-action lawsuit was filed in 2019 on behalf of 500,000 home sellers in Missouri and some border towns with a verdict stating that the Brokers/Defendants “conspired to require home sellers to pay the broker representing the buyer of their homes in violation of federal antitrust law.”*

There is a LOT of talk in the news this week, about Realtors and commissions, and a sad but ever familiar undercurrent echoes in the messaging being reported by News and Media outlets….basically accusing Brokers and Realtors of rigging the system and making too much money. The National Association of Realtors (NAR) lawsuit settlement announcement that was talked about in the news this week has been a topic of conversation among the Realtor community for many months, ever since the first-class action lawsuits were filed against several large brokerages like Re/Max, Redfin etc. That first class-action lawsuit was filed in 2019 on behalf of 500,000 home sellers in Missouri and some border towns with a verdict stating that the Brokers/Defendants “conspired to require home sellers to pay the broker representing the buyer of their homes in violation of federal antitrust law.”*

What does the federal antitrust law prohibit? It prohibits conspiracies that unreasonably restrain trade, i.e. agreements among competitors to fix prices, rig bids, or allocate customers. The plaintiffs in the first lawsuit, and in several that cropped up afterward claiming similar breaches, specifically took issue with with NAR’s requirement that any listings entered into the MLS by a participating Realtor must include a published offer of compensation (could not be $0) to a cooperating buyer broker. They claimed that this “cornerstone of the conspiracy” was a rule that unfairly then required sellers to pay for the cooperating buyer broker commission, and alleged that sellers were effectively unable to negotiate the compensation amount offered to the buyer broker.

In my humble opinion, there may be a valid issue here about NAR’s requirement to publish a “minimum” offer of cooperating commission in order to participate and list properties in the MLS; however, NAR did recently change those guidelines, allowing participating agents to list properties with a published offer to cooperating brokers of $0 or more. Was that a correction by NAR because the former cooperative compensation rule/requirement put their members (brokers and agents) in jeopardy of breaching antitrust laws? It does track. So maybe that old rule should have never been in existence, but what is not accurate is the claim that the amounts that were published in the MLS for cooperating commission offered to a buyer broker were ever fixed or unable to be negotiated by a Seller and their Listing Agent.

The claim went ever further to suggest that “due to industry-wide collusion, agents steer their buyers to properties with larger compensation offers or higher overall price tags in order to receive a larger payout, which the complaint says hinders “innovation and entry by new and lower-cost real estate brokerage service providers.”* This is that dark and sad undercurrent hinting that greed motivates the industry and those that are practioners within it, and frankly……IT PISSES ME OFF.

Let’s talk about commission, openly, and transparently – I’m not scared of talking about it and it is nothing fixed or non-negotiable. For the purposes of selling residential real estate, as it stands, the practice has been that a listing broker/agent gives a Seller a Disclosure about what agency relationships are and the requirements of representation under the statutes of the Department of Real Estate in California; that Seller can then decide if they want to execute one of a few different types of Residential Listing Agreements, which are standardized forms provided by the California Association of Realtors for use by participating, licensed brokers/agents in the State. In the most common Residential Listing Agreement, there are fields where commission amounts are to be indicated and agreed upon for both a total commission owed to the Listing Broker toward the top of the 1st page, and about half-way down the page if and how much of that total commission is to be offered to cooperative buyer’s brokers. There is language throughout the agreement to explain the importance of publishing the property on the MLS and what the implications are if the listing broker/agent does not include the listing in the MLS, and initials required where the seller and the broker have to acknowledge the same; and the contract allows them to opt in or out of the MLS with the understanding of how that may affect their sale. This is partly to be sure sellers/consumers understand the role that syndication of the property listing to buyer search sites such as Zillow come primarily from MLS data and that, by excluding their listing from the MLS, it could detrimentally limit their buyer pool. This language is included to prevent brokers/agents from withholding their listings from the MLS without the seller’s knowledge in order to improperly “double-end” sales by attracting the buyer directly without allowing fair and competitive cooperation that would benefit the seller and comply with fair housing practices, and ultimately limit a possibly higher sales price on the home.

These contracts are literally written to protect sellers/consumers and encourage fair competition, not to collude or fix commissions, and in no way is it communicated that commissions are non-negotiable. However, in California, Brokers and their Agents who are independent contractors and licensed practitioners can refuse to represent a Seller or a Buyer if the commission offered by the Seller is not commensurate with what that Broker/Agent feels their services are worth, and there is nothing prohibiting a broker/agent from asking for a commission rate that they feel reflects the value of the services they provide. Ultimately, the market has widely dictated what Brokers/Agents have been able to ask for and get paid to be competitive with their fellow practitioners. When the market is hot and sellers are flooded with multiple offers in days, the commission rates typically fluctuate down and agents negotiate their commissions more deeply as a result; just as in a tough market with a glut of inventory and long durations of homes on the market, commission rates trend up with agents asking for more because of what is required for marketing, exposure, and cooperation strategies in order to be successful.

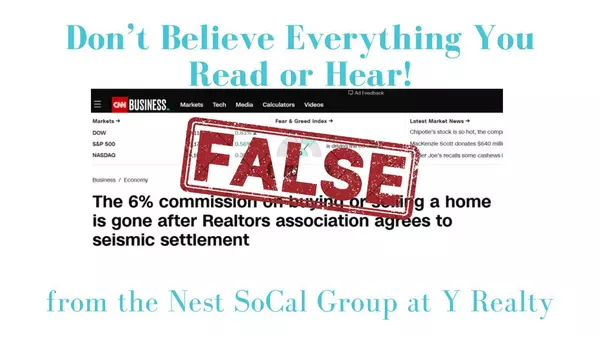

What I hate hearing this week from News outlets is the misrepresentation that the new NAR settlement is making the “Standard” 6.0% commission rate a thing of the past, and that NAR has agreed to “Slash” commission rates. Guess what, there is nothing “standard” about commissions, and NAR didn’t agree to slash anything, but what they did agree to what the elimination of offering ANY published amount of cooperating broker commission in the MLS. That decision will have implications for consumers that will likely change the landscape for homebuyers and their willingness or ability to purchase.

Let’s look at a hypothetical example if this settlement is approved by the Court and if the removal of advertised cooperating broker compensation goes into effect in June/July 2024 as expected.

First Time Home Buyers, Jordan and Alex Smith, want to purchase a property this July where there is limited inventory and high demand. They have a 20% Down payment and are preapproved for conventional financing with anticipated average closing costs of 2.0% of the loan amount. They interview a few agents to see who they feel would be able to help them identify a property and represent their interests in negotiating a contract for a purchase. In this new market, where there is no commission advertised to compensate a Buyer’s Agent for bringing a qualified buyer that successfully purchases a home, the Buyer’s Agent, rightly so, asks Jordan and Alex to sign a Buyer Representation Agreement that indicates the commission the agent shall be paid is “X" for their representation and services; it also gives the agent authority to negotiate that amount to be paid by the seller in a resulting sale, but dictates that if the seller will not pay the commission, the buyer is responsible for paying it at the close of escrow.

Both Buyer and Buyer’s Agent agree to terms and begin house hunting; a property is later identified, and an offer is made. In the offer, the Buyer’s broker includes a term that the seller is to compensate buyer’s broker in the amount of “X.” Meanwhile, the seller also receives 3 other offers and counters back to all buyers that they will not pay any amount for the Buyer’s broker’s compensation. Jordan and Alex are then in a position to decide if they want to pay for their 20% Down payment + 2.00% closing costs + “X” to pay their broker. Ultimately, there are several different outcomes that could result. One outcome could be that they, and all or some of the other offers, counter back at a lower price to offset the total cost to the buyer; or Jordan and Alex could counter back and reduce their down payment to apply some of their cash as an allocation toward their agreed upon Buyer’s Agent commission, thereby restructuring their loan, and creating a higher monthly payment for themselves, which may also prompt them to want to reduce the price to offset the higher monthly payment; or they could agree to all terms and chalk it up to demand or some iteration of the above. If the seller wanted to “slash” the amount of commission they were responsible for paying, they should be prepared to slash their sales price in turn.

But what if Jordan and Alex were first time home buyers with a limited budget and preapproved for a 0% down VA Loan, rolling a portion of their closing costs into their loan (the VA Funding Fee), to reduce the total cash due at close as afforded to them through the VA Loan benefits they earned for their Military Service. Guess what? Jordan and Alex could NOT agree to compensate their Buyer’s Agent because commission is a non-allowable expense under the terms of the VA Loan. They can sign a Buyer Representation Agreement with the express understanding that the Buyer’s Agent commission of “X” must be included as a term in offers to be paid by the seller. Let’s say the same offer is made as in the example above, and the seller rejects payment of any Buyer’s Agent commission – in this case the buyer cannot agree to that term and pay their own agent, as it is prohibited by their VA loan. Is it fair for their agent to receive $0 compensation; are these buyers going to have to go directly to the listing agent (called dual agency) without their own advocate in the future; and/or is the seller unfairly discriminating against the VA Buyer, who is part of a protected class as a Military Veteran and strictly prohibited from paying commission?

This is going to be a minefield folks.

Let’s say the Buyer’s agent is willing to negotiate their commission rate down from what was agreed upon in the Buyer Representation Agreement, or that the Seller agreed to pay some portion of the amount indicated in the original offer. That could happen too, but what is fair and reasonable compensation? Cue the dark undercurrent again…..

A lot of consumers have a skewed view of the take home income Realtors actually make and why (most) have earned their income many times over. Real estate agents typically operate as a sole proprietors/Independent Contractors, who must obtain a license to practice real estate under a Broker in California. There are STRICT legal and ethical guidelines, mandatory educational requirements, a State exam and licensing requirements, and constant continuing education expectations that a Realtor must adhere to in order to practice real estate in California - for both listing agents and buyer’s agents. Once licensed and in good standing, agents can conduct sales and earn commissions. We typically have to pay a split of the total commission amount (Gross Closed Commission or GCI) to a broker, the average of which is 20%; and we are independent contractors, so we have a myriad of business expenses associated with marketing and advertising, business equipment, transportation, technology and subscriptions, health insurance, professional insurance, continuing education, etc., and the expenses can vary widely, but on average work out to be 35-42% of the GCI or more; and if acting as a sole proprietor we have to pay self-employment tax in California, so after deducting expenses, the total anticipated income tax rate is between 41-43.5% for Federal and State. You can see that the take home income that we as agents receive is FAR less than the total commission rate.

Further, Realtors don't typically (or ever) charge any money up front for a consumer to retain their services. Let's consider that it takes an average of 2-4 months working with a Buyer to result in a closed sale where a commission can be paid with an average of 20-40 hours performing work for that client in a licensed, professional capacity without any pay until the successful conclusion of that sale. How many other professional services industries operate like that?

As a comparison, a Real Estate Attorney in California can expect to be paid an average of $422/hr and they typically require an upfront retainer to cover their initial time and expenses when hired. Attorneys are also licensed practitioners, who have similar professional requirements. Ironically, when residential home sales in California require Court approval, like in probate proceedings, the attorney and legal fees involve mandatory minimum formulas – isn’t that price fixing? Just saying….it feels a tad like hypocrisy, especially when the attorneys in the class action lawsuit against NAR and Brokers stand to make up to the “standard” 1/3 of the $418Million class action settlement, which should be a new point of contention among the plaintiffs.

The long and short of it…..we will find a way through all of this, and I will be here for it to help guide my clients along the way. I believe there should be more transparency and better communication between Realtors and Consumers, but I am really tired of the messaging rife with the tone of greed and unethical behavior being reported in the news. The majority of Realtors I know, and I, work really hard to constantly learn, improve, and practice real estate ethically and responsibly. I try to bring what I've learned from every sale I've been a part of into my practice so that my clients can have a better understanding of what to expect and a better experience when selling or buying a home.

Just when I think I have seen it all, there are new changes, inspections, contract requirements, laws, tax implications, marketing technology, and more that change the face of what impacts sellers and buyers, and how I practice real estate in California. I will continue to adapt, as I know my skilled and valuable colleagues will too, and I hope to be a voice that not only advocates for the value of good Realtors, but how these new commission changes can enhance, and not hinder, the experience for consumers. I can only help to change the narrative if I can help to broaden the beliefs and perceptions about Real Estate professionals, and I hope to do just that.

Thanks for the read!

-Your friendly neighborhood Realtor, Noelle Longmeyer

*Lawsuit insight sourced from https://www.housingwire.com/articles

Categories

Recent Posts